Save the planet and your wallet as EV insurance premiums plummet

We already know about the benefits of driving an electric vehicle when it comes to saving the planet, but falling insurance premiums mean you can actually save money too! This is according to the latest figures released by Comparethemarket.

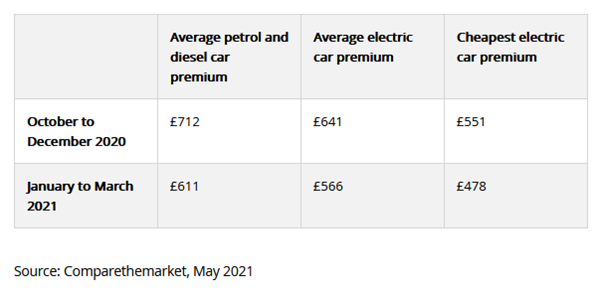

The price comparison experts have recently released their figures from the first quarter of the year, which show that the average annual cost to insure your EV has dropped by £75. These results mean that electric vehicles are now typically £45 cheaper to insure than petrol and diesel vehicles, adding to the many benefits of making the switch to electric.

This table shows the average insurance premium from the start of this year compared to the end of 2020.

Other ways you save with electric cars

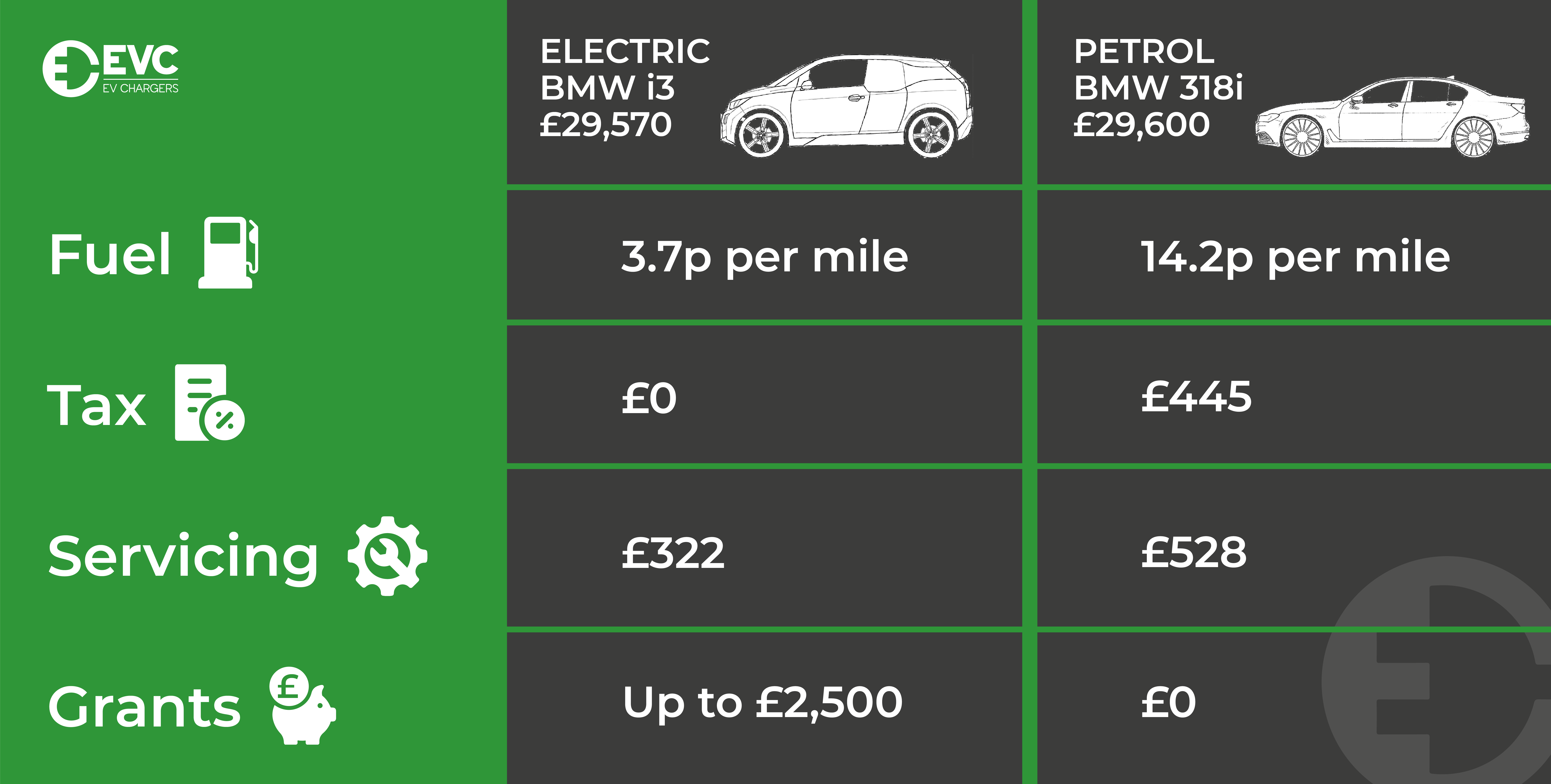

Insurance isn’t the only way to save money when making the switch to an electric vehicle, there are many other benefits to consider, such as fuel cost and car tax. Electric vehicles are exempt from car tax due to them producing zero emissions, so that is already a saving of £155 a year in comparison to a petrol car.

When it comes to fuel, there’s only one winner. On average, an electric vehicle can run for 100 miles at a cost of £2 - £6 when charged at home, or around £6 at a motorway charge point. To compare, 100 miles in a petrol or diesel car would cost around £13 - £16.

Here’s a breakdown of some of the savings you could make.

Source: Thatcham Research, KeeResources & manufacturer data.

Considering making the transition to an electric car?

Check out our How it Works page to get a better understanding of how we can support you with installing charging points to kickstart your EV journey.